FLOST WILL BE ON THE BALLOT NOVEMBER 4, 2025

FLOST WILL BE ON THE BALLOT NOVEMBER 4, 2025

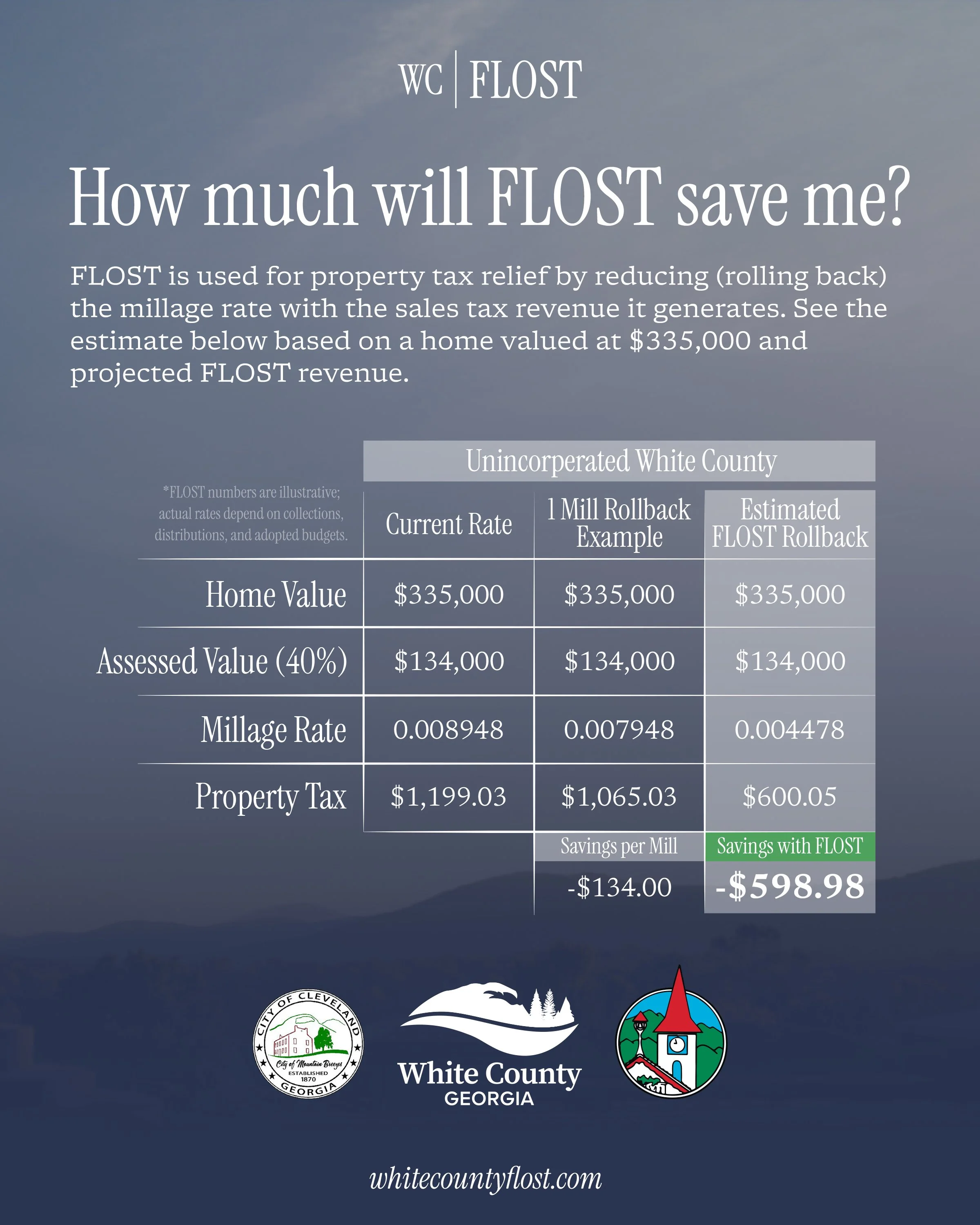

FLOST: A 1% Sales Tax Dedicated to Property Tax Relief

Collected county‑wide for up to five years and used exclusively to reduce the property tax millage rate for White County and the Cities of Cleveland and Helen.

FAQs

-

FLOST is a 1¢ local sales tax used exclusively to provide property-tax relief by rolling back millage rates. It is not a general-purpose revenue source.

-

Across White County and within the Cities of Cleveland and Helen, under an intergovernmental agreement (IGA) that details how revenues are shared and applied.

-

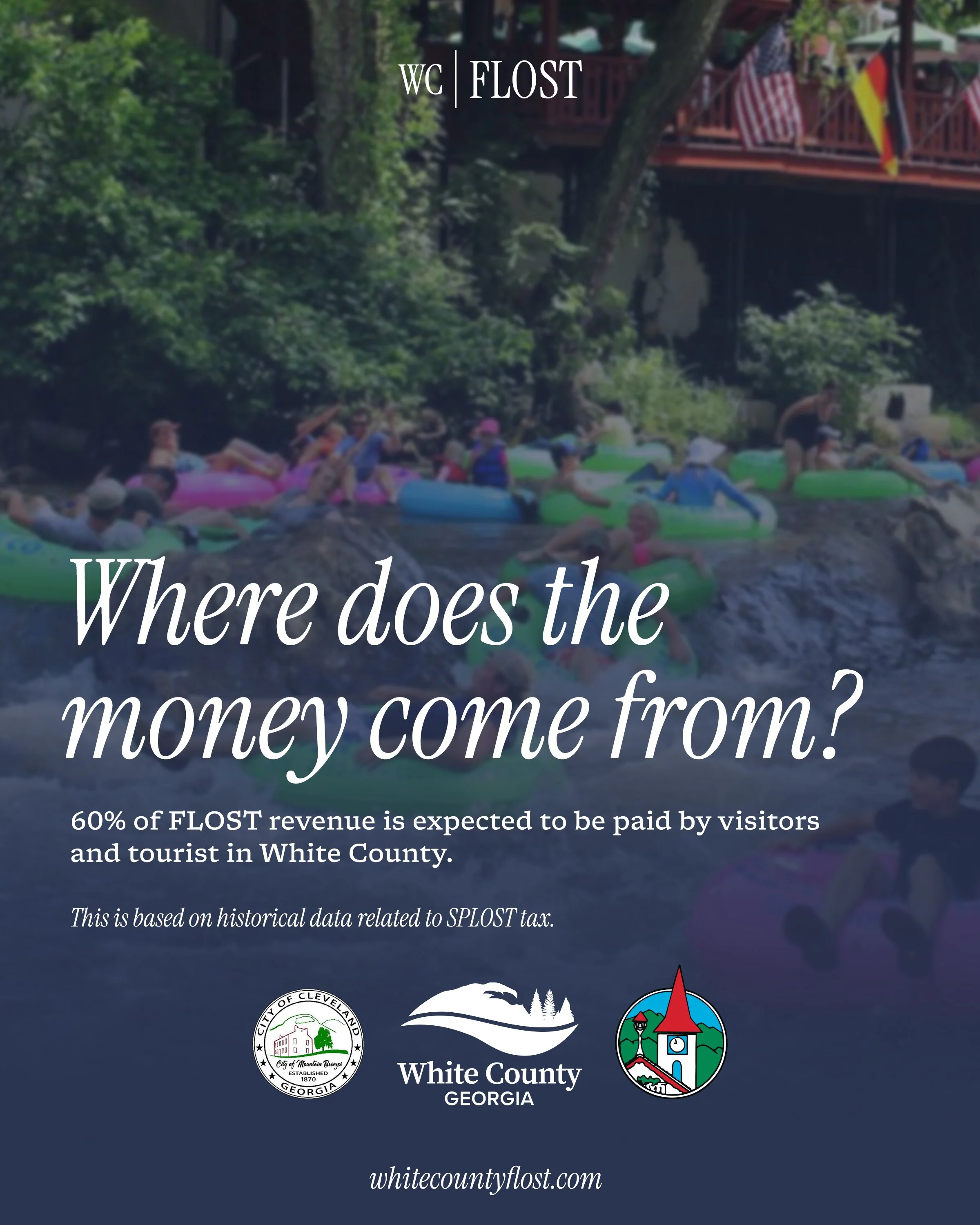

Everyone who shops in the county, including visitors. Historically, visitors have paid a significant share of local sales taxes (about 60% of SPLOST), helping support infrastructure used by residents and non-residents alike.

-

Collections can run for up to five years per authorization, and revenues/expenditures are reviewed by an independent auditor.

-

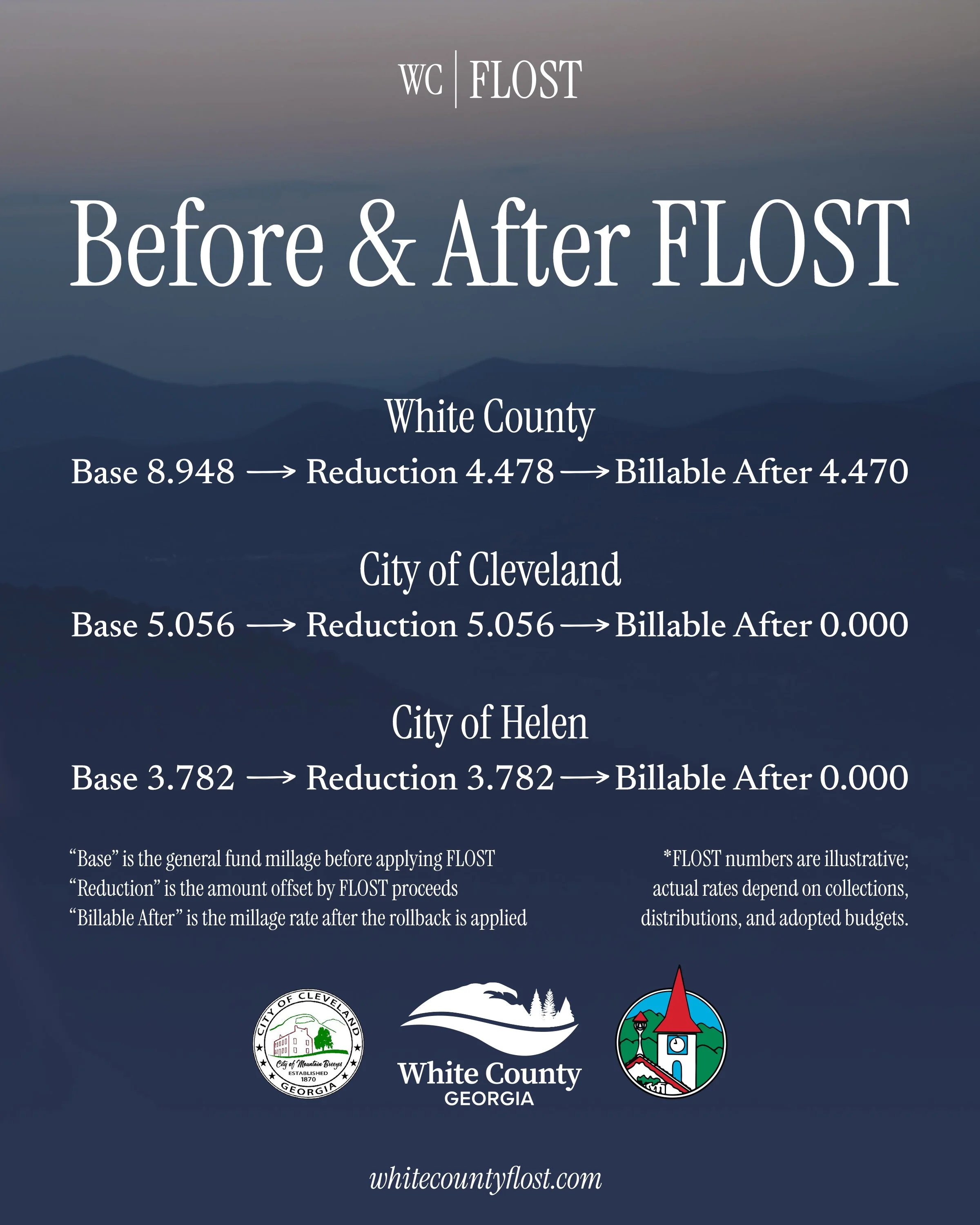

All property classes—residential, commercial, and industrial—benefit when millage rates are rolled back.

-

No. If a city’s rollback would drop its millage below zero, the excess is returned to White County to further reduce the County millage.